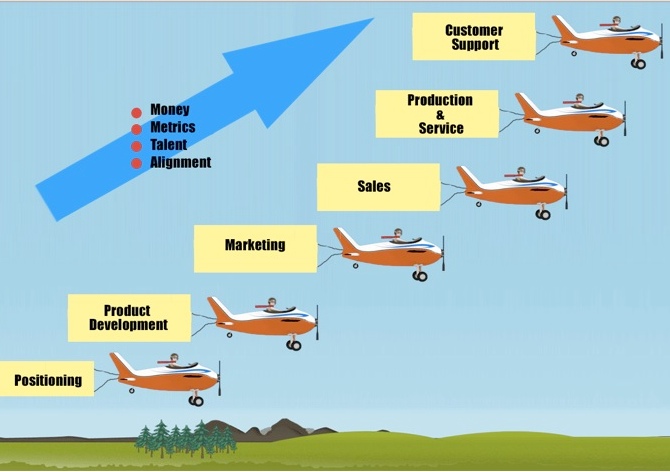

Scaling is Growth with CAPS – Control, Alignment, Predictability and Safety.

Or in order of importance: Alignment, Control, Predictability and therefore Safety. But that doesn’t make a great mnemonic!

But here is the problem. Most private businesses can’t scale because they will not, or can’t decide what their remarkable service is going to be. If you don’t choose something specific to dominate, to be the best in the world at, you will never scale.

Scaling isn’t about being the biggest. It’s about building an increasingly stronger and safer business. For example you could build a big business on the back of a few customers. You could be in process automation and you successfully secure a huge $50m contract to supply a biomedical contact manufacturer, or you could be in IT recruitment and you could secure a huge requirement from American Express to supply Java developers. So you may be bigger but you are dependent and skewed to one customer, which is not safe!

However size matters. Small businesses are inherently unsafe. Small businesses, those employing less than 100 people or 99.6% of US enterprises, struggle with aligning their resources around one cause. Look at these great Boston examples, HubSpot, Carbonite, Pixability and Acquia. They are all focused on one segment of the market. They are able to align their resources around one cause. Therefore they can drive towards predictability of revenue and ultimately visibility of earnings. If management execute correctly they have a chance of gaining control of the key metrics and to build a safer business.

Most private businesses don’t create this opportunity. They swing from highs to lows, struggling to make payroll, with very little ability to predict revenue and therefore to gain control and ultimately achieve safety.

So to achieve scaling and all the benefits it brings, you need to reach a minimum size. This will vary from sector to sector. Scaling costs money. To put in place even “lite” versions of large company infrastructures isn’t cheap. What’s the minimum size? My commercial view having been immersed in small businesses on both sides of the pond is that you probably need to reach close to $3m in EBITDA (earnings before interest, tax, depreciation and amortization) to create the safety that scaling can bring. Staying smaller than that is fine, it just isn’t safe. In addition check out my saleability test which gives you 15 indicators of how safe your business is.

The Portfolio Partnership offers interim CEOs, COOs and CFOs to scale clients both organically and by acquisition. Contact Ian – ian.smith@portfoliopartnership.com