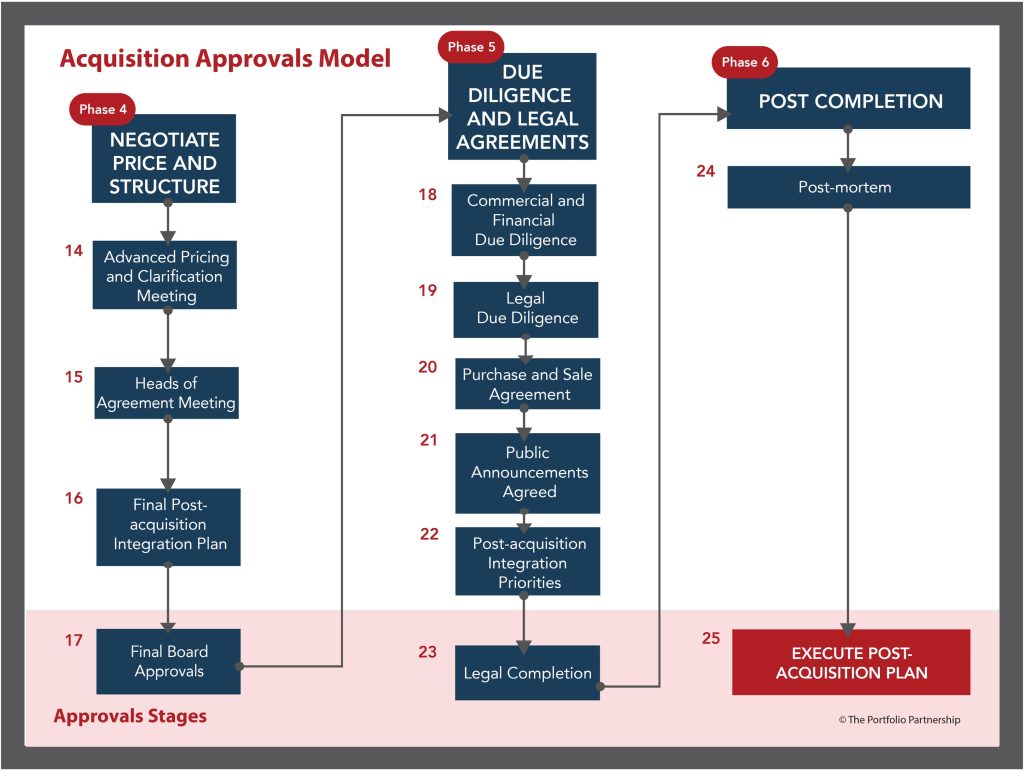

This 6-part blog series is based on our Acquisitions Approval Model. In practice this model may not flow in a sequential manner because circumstances can change quickly. A target owner who is in dialogue with you in Phase 3 may stall for several months, motivating you to activate more targets to put in play.

In this blog post, we examine Phase 2 which includes the following 4 stages:

- Assemble the acquisition team.

- Find targets, collate basic facts, prioritize list.

- Review post-acquisition integration headlines for top 10.

- Produce a communication plan for the top 3 to enable contact with owners.

At the end of Phase 2 you should be ready to reach out to the highest priority target to start a conversation. This phase translates strategy into action by using the agreed Acquisition Profile from Phase 1 and searching for targets aligned to your objectives. It’s an opportunity to assess your long list of targets identified to enable a prioritized list to be produced. This is where we craft a story of why we are interested in each priority target.

Common mistakes

Most acquirers have a process they follow, but in our experience, too many acquirers are falling into these traps:

- Acquisition team consists of a corporate development lead and an external investment banker, omitting an operational expert.

- Research is limited to targets that are easy to find from a limited number of databases. Many potential targets that are divisions or part of a larger group are missed.

- A filter system to enable prioritization of targets is not agreed up front, leading to inconsistent conclusions.

- A lack of deep operational knowledge of the sector allows irrelevant targets to remain on the list or worse, attractive targets to be missed.

- Post-acquisition integration is not considered leading to poor prioritization. This leaves targets on the list that would be a nightmare to integrate because of their pricing model, complexity of product, location, sales model etc.

- Assessment of the top 10 targets is incomplete demonstrating a lack of understanding of their positioning, their technology or their people (desk research prior to target contact can uncover a fairly rounded picture of the target).

- The communication plan lacks insight and often delivers a poor first impression to the potential acquisition target shareholders.

A better way

- Sequester some operational experts from their day jobs to support the team. It will depend on the sector, but in the high-tech product manufacturing space, you’d want your manufacturing director, product management director and a financial controller to supplement the corporate development team.

- Research everywhere including trade show attendee lists, PE portfolio companies, divisions of public companies, and of course all the standard company databases of that country. Use SIC and NAICS codes where relevant. Examine specialist reports that cover your sector. Review Gartner’s analysis of the sector. Talk to investment banks, lawyers, accountants. Engage with the market. Assuming you are not embarking on a confidential diversification strategy (and if you are, please be very careful) share your Acquisition Profile with all your network, investors and your employees. The objective is a long list to be curated later. Consider appointing a research house to build the map if internal resources are not available.

- Once you have the long list, apply your filter criteria to curate down to say 10 top targets. It’s irrelevant whether these targets are up for sale. That will come later.

- Build a cheat sheet for each prioritized target. We call it an early discovery sheet. It includes the strategic gap that is being fulfilled, ease of post-acquisition integration, key positioning of the business, quality of management, major customers, locations, headline financials if available, number of employees, any competitive value proposition they claim, IP and patents noted, major news announcements, product summaries, sales growth. Allocate a score from 1 to 10 to each criteria to enable target comparison.

- Build out a pre-contact checklist and populate for your top 3 targets. We have 23 on our template covering answers to point 4 above plus shareholders plus qualitative questions like, are they expanding?

- Produce a communication planner prior to you reaching out to the relevant contact in the target. In private companies that is likely to be the majority shareholder.

- Who is the individual you are contacting?

- What is the primary purpose of the communication?

- What specific talking points are essential to communicate?

- Why does acquiring this target make sense?

- Why would your ownership be good for shareholders, management, employees of the target?

- What am I asking the target shareholders to agree to?

- Anticipate top 5 objections and questions with answers. Build a Communication Planner for your top target covering:

By taking this approach the acquiring team is setting themselves up for success. When the approach is made, it will be clear to the target that you have done your homework. There is only one first impression. Overpreparing has few downsides.

TPP is buy-side investment banking reimagined. We seamlessly become an extension of your team and integrate at all levels to add deep mergers & acquisitions into your business.