If you are in a leadership role driving the agenda of a private company, trying to significantly increase shareholder value and especially if the shareholders are considering a sale in the next three years, then this post is for you.

Our team have run businesses as principals, all over the globe through the 80s, 90s, and beyond. But for the last eight years we’ve been embedded as fractional C-Suite executives, operationally driving shareholder value for clients in over 11 New England business. Some of those businesses have sold out at premium valuations, some will sell out at premium valuations over the next 12 months and some will probably never sell.

Rarity

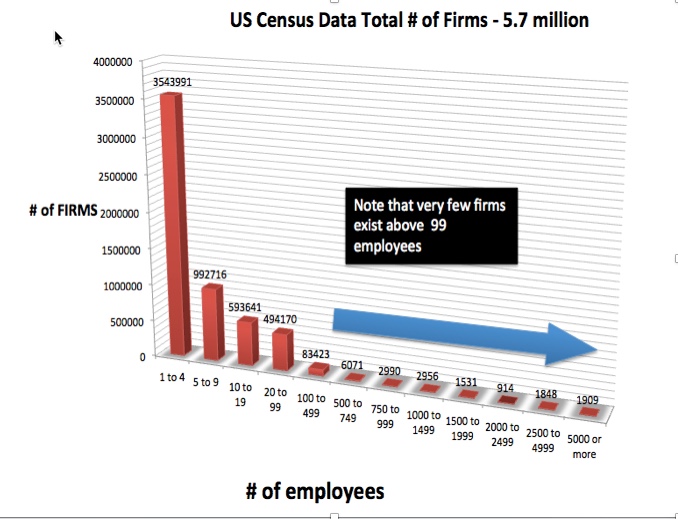

We show our clients this graph when we first meet. The first thing to note, as the owner(s) of a private company, is the reality of how rare it is to scale a private company.

Look at how few companies scale beyond 20 staff! Out of 5.7 million running a payroll (US Census Data) only 600,000 firms employ 20 or more. And the number of firms employing 100 employees more is only 105,000.

That’s why offering a framework to scale is needed. This post offers a framework for measuring shareholder value and measuring the important criteria as you scale.

Public companies have similar frameworks but wondering how much they are worth is not one of them. A public company’s value is measured every minute of the day, sometimes harshly as shares are bought and sold. As we’ve seen so recently, volatility in the market can drive a public company’s value downwards overnight. Often totally unconnected to the strategy being executed.

A private company doesn’t have that barometer. Of course, that’s a good and a bad thing. Good in that you avoid the short-termism, the swings through volatility, the constant microscopic view of your company by the analysts. But you also don’t get the feedback on value. A private company’s management must seek other ways of measuring progress and value. We look at this problem through the eyes of the only person who can truly place a value on a private company – an acquirer.

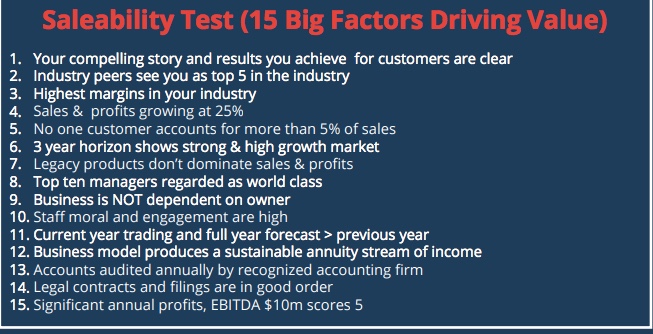

This framework will be familiar to regular readers of this blog. The lens of an acquirer is called, The Saleability Test. Why would a bigger brother buy your company? And more importantly what playbooks have we deployed with success across multiple sectors. These playbooks have allowed our clients to scale, build stronger businesses, sail through due diligence when selling, and attract much higher EBITDA multiples than market averages. They have forced clients to curate, focus, and accelerate initiatives that move the dial. Working on the wrong stuff is the biggest crime of any management team. We rarely find evidence of not working hard enough, just evidence of not working smart enough.

Here is our table of how acquirers look at businesses. It sets our 15 drivers of value. We call it the Saleability Test, because if you are scoring below 60 out of 75 you are in danger of building an unsaleable business (I’m defining unsaleable as incapable of attracting any offers from acquirers or at least only derisory ones).

Do the test. Max score 5 for agreeing with each criteria. Score your company and start addressing where you are weak.

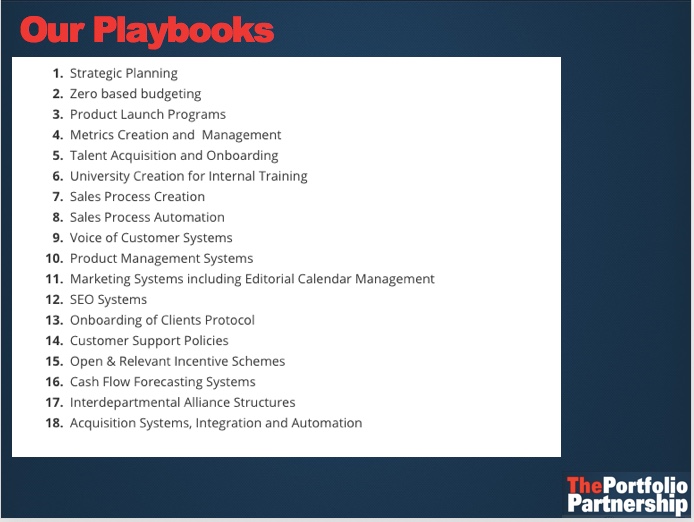

Here are the Playbooks we deploy over time. If you want to dig deeper, every single playbook has been covered by numerous blogs. Use the search box on the right-hand column of our blog to explore areas of interest.

Summary

It’s easy to work on the wrong stuff. Setting out a blueprint that directs talent to work on the right stuff is essential. Deploying the appropriate operational protocols, systems, measurements and organizational structures makes a huge difference to building shareholder value. Scaling a business to increase value contains key elements including control, alignment, predictability and safety. When scaling is done well, stakeholders see a strong alignment between actions and corporate objectives. They notice higher levels of controls around essential functions of the business. Predictability becomes more accurate and forecasting achieves higher levels of credibility leading to a great place to work and a financially safe company to join.

For those shareholders considering a short to medium term exit, addressing this framework will substantially increase your exit value. For those shareholders of a private company playing a longer game, why not validate that you truly are building shareholder value, while having fun.

Reach out at Ian@TPPBoston.com