Raising venture capital immediately transforms your balance sheet into a platform for scaling. Of course failure is still a high probability. Especially if you execute the wrong things. But that immediate injection of capital allows management to roll out their planned tactics. In effect to travel from one balance sheet to the next. In extreme circumstances eg a Software as a Service, SaaS business (think Hubspot, Salesforce) that injection of capital allows the company to hemorrhage cash for years, burning through cash, shrinking the balance sheet year after year until, hopefully something magical happens. The products gains traction, sales start accelerating and the business starts to generate more cash than it spends and the balance sheet starts to rise again. Of course 90% of start-ups never see that magical moment. The punt doesn’t work.

In the non-VC world, businesses that make a loss are called products not businesses. To be called a business you really need to make a profit and convert most of that to cash to survive. But how do we align our scaling plans with our balance sheets? In my opinion most management teams don’t understand balance sheets and certainly don’t reconcile what their tactics, over the next 365 days, will do to that opening balance sheet. And you really need to understand the interplay between balance sheets and tactics and scaling or you’ll never deliver the success you deserve.

So how do we scale without a huge injection of capital? You self fund. You build a business model that is profitable from day one and scale with a close eye on increasing margins, cash flow and balance sheets. It requires a fresh approach to budgeting, sales pipelines, cost control, working capital and cash flow forecasting. It requires a totally integrated set of playbooks across all aspects of your business. Following these guidelines will allow you to visualize and deploy tactics that will scale and are self-funding. It will also allow you to articulate to a banker or external funder, if you really want to accelerate your scaling, how to use additional external funding when you don’t need it.

Guidelines

- Build a budget for next year not with numbers, at first, but with a set of well-articulated policies that you know you have the skills to execute. Don’t leave anything out. Product innovations, marketing campaigns, customer support investments, sales team recruitment. Everything.

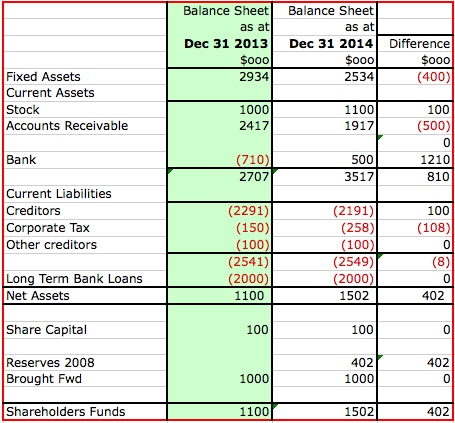

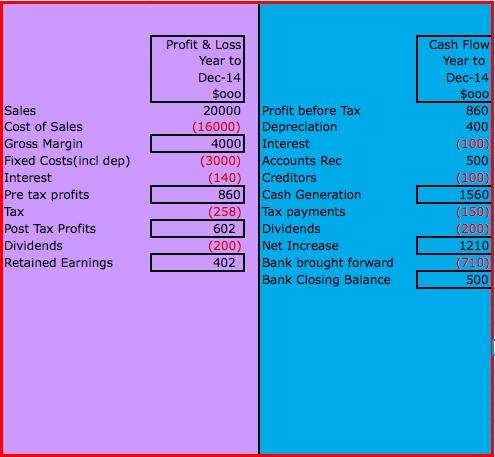

- Treat point 1 as your working assumptions for your finance team to create a financial model that attaches real numbers to all of these tactics. Ensure the model clearly shows opening balance sheets at the beginning of the year, closing balance sheets at the end of the year and the difference between them, being your cash flow and your profit and loss. Ensure every moving part of your financial model is connected to a key assumption you articulated in 1 above. These assumptions will be your levers to play with.

- You are now able to see instantly, the impact on your closing balance sheet of executing a given set of tactics. Often this reveals the opening balance sheet just isn’t strong enough to go on the journey you want to go on. That’s ok. There is always an appropriate journey that is profitable and safe. Now you get to play with the tactics until the model demonstrates that the opening balance sheet will fuel the journey.

- To blow away the mystery that all business success is merely the difference between two balance sheets, I’ve created a little worked example. This works at $1m or $10 Bn. Your tactics are represented by the difference column.