I’ve been talking to Tom Deans (best-selling family business book) and John Leonetti (Great book – Exiting Your Business, Protecting Your Wealth) about the renewed interest in exit planning. The next 5 years are an unreasonably important time to be building a business for sale whether to a strategic buyer, a PE group, an MBO team or an ESOP type arrangement. However I remain deeply concerned that most owners of private businesses are totally overestimating the value of their business and whether it is saleable. So I’ve pulled together some statistics for owners and their advisers to act as a little catalyst. These stats are a reminder that you may think you are creating a remarkable business but sadly you may not.

- 70% of business owners report that their business is their primary source of income – successful exit becomes critical to retirement.( Note 1)

- 5% of American business owners are currently generating 90% of the incremental value being created by private firms. (Note 2)

- For households with more than $50 million, 86% of them own (or owned) businesses. For households worth $1m to $10m, 51% owned businesses and for households worth $10m to $50m, 67% owned businesses. The question is, how much of that will be monetized and turned into cash?

- Pepperdine University studies have shown that on average a private company’s cost of capital is 25% to 30%. This is one of the factors creating an ominous value gap between what the owner needs the business to be worth versus what the market says it is worth, often an acquirer.

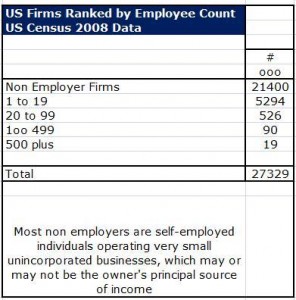

- From the 2008 US Census figures, there are approximately 27.3m US firms.

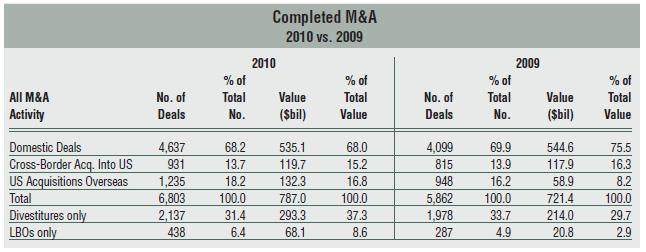

6. According to Mergers & Acquisitions magazine there were 5568 US deals last year with a value of $10m or more – Domestic Deals 4637 & Cross border acquisitions by overseas acquirers into the US 931, totaling 5568.

7. Therefore broadly speaking the odds of a private company selling out for $10m or more are 17 in 100,000 or 1 in 6000 chance.

8. Given the 5568 deals mentioned above contain a number of public company deals and that the total of all firms at 27.3m contain only 15,000 public companies the odds of a private company selling out are even worse.

9. At 7% return on your capital and assuming you own 75% of your company, pay taxes and fees on the gain at say 25%, to ensure an income of $393k pre tax you would need to sell your company for $10m.

10. Robert Avery of Cornell University has researched the impact of retiring Baby Boomer business owners. 70% of these businesses (2006 Robert estimated this at 12 million firms) are expected to change hands in the next 5 to 10 years.

11. Many private businesses are ascribed a commodity level of valuation of 5 times post tax profits.

Building businesses buyers love to buy isn’t an exit strategy it’s an options strategy. By building a remarkable business, by looking at your business through a buyer’s lens you give yourself options. Aligning shareholder objectives and Corporate objectives has never been more important.

Please share your thoughts.

Note 1: Exiting Your Business Protecting Your Wealth, John Leonetti

Note 2: Midas Marketing, Rob Slee

Excellent research. Thanks. Love the point about the number of M&A deals over $10M