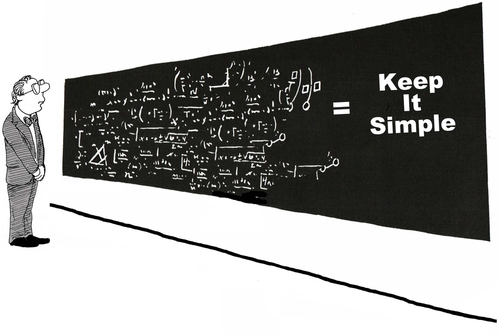

I don’t really care what you call your head of finance. I do care as the CEO, what you should expect from the key financial executive. Scaling a business requires insight into what is happening out there. Think of the finance department as the metrics department. And the head of the metrics department needs to answer the simple question: Why? The stories behind the why, are discovered by deploying smart questions.

The Questions

- What are the key drivers to transform the profitability of our business?

- What products are the most profitable?

- What are the main reasons for quarterly Gross Margin & Net Margin movements over the last 12 months?

- What are our most successful distribution channels?

- Which marketing campaigns have had the greatest ROIs over the last 24 months?

- What are the 10 key reasons reconciling last year’s pre tax profit with this years forecast?

- How accurate are our weighted pipeline sales forecasts throughout the quarter compared to the final result?

- What actions are required to improve our weekly cash generation?

- What are the absolute $ amounts and the annual cost growth % of all of our main suppliers over the last 5 years?

- What does that translate to, on a unit cost basis, again absolutes and % terms?

- Taking all cost lines as a % of sales, which % have grown the fastest and why?

- Which ratios would you use to measure productivity and illustrate your point using 3 years worth of data?

- What changes to our pricing model could improve our sales and profits?

- What best practices could improve our bottom line if they were to be rolled out across the group?

- Which multi-departmental projects have we executed over the last 3 years and what was the ROI% compared with the expectation. If non financial objectives were set, then were they achieved?

- If you were to take a zero-based budget approach to our infrastructure what recommendations would you make?

- Where are the greatest risks to our planned profit target for this year and what actions could be taken to reduce that risk?

- What IT systems that are currently being deployed are failing us, and why?

- What new technology investment would significantly improve our performance, anywhere in the business?

- What are biggest constraints holding back our business?

Specific industries will generate more detailed, very parochial, relevant questions e.g. SaaS, oil and gas, niche manufacturing, healthcare, financial services and service industries. However your CFO may still be in shock from the first 20 before she can answer more detailed questions!

The Portfolio Partnership continues to offer successful,experienced operational partners with know-how, to assist management teams scale their businesses by executing their strategic plans. Ian@TPPBoston.com.